Mayo Report for 2012-03

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

Marvel re-entered the top 10 comics list in March 2012 with three comics. "Avengers vs X-Men" #1 was at the top of the top comics list with around 203,200 units. "Avengers vs X-Men" #0 sold around 134,522 units and "Avengers Assemble" #1 came in rank five with approximately 100,893 units. DC took the rest of the top ten with "Justice League" #7, "Batman" #7, "Action Comics" #7, Green Lantern#7" and "Detective Comics" #7 continuing to be very strong sellers. Marvel had the largest share of the total unit sales of the top 300 comics with around 41.7% while DC had around 39.12%.

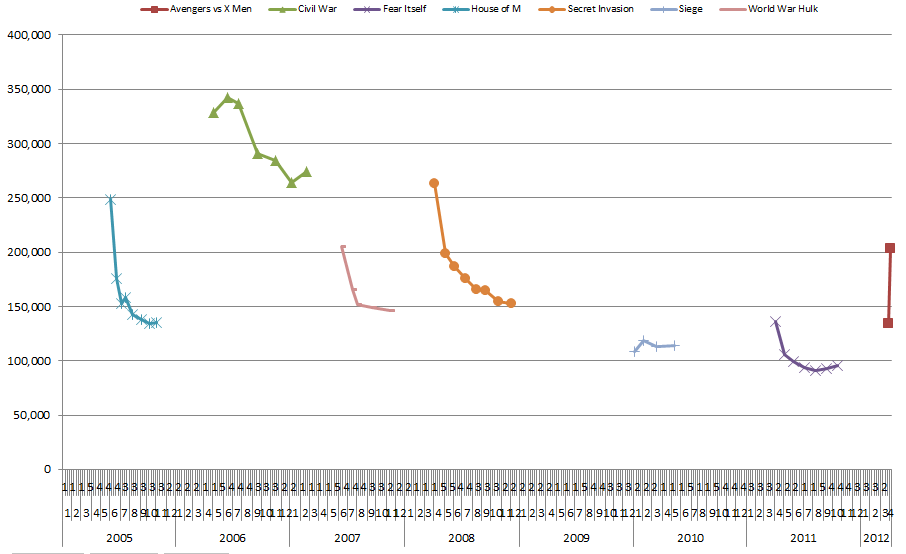

Event titles like "Avengers vs X-Men" typically sell well for Marvel with "Civil War" hitting a high water mark for events back in 2006. Not only do these event titles tend to sell well initially, they often have a longer shelf life with a much higher level or reorder activity than the average comic. As much as people might complain about events or cite "event fatigue" as some sort of wide spread problem, major events like "Avengers vs X-Men" sell gangbusters. Until that trends changes, expect both Marvel and DC to continue with large scale events in the coming years.

This chart shows the total reported sales (both initial orders and later reorders) for the main title of the various Marvel event titles over the past few years:

Things like "Civil War: The Initiative," "Dark Reign" and "The Heroic Age" were not events in the typical sense. Those unified a bunch of connected storylines in various titles under a comment marketing banner but lacked a core title telling any sort of central storyline. The chart also does not include the smaller "incidents" published by Marvel over the past few years. While many things like "Shadowland" and "Spider-Island" are referred to as "events" by many fans, there is a clear difference between a storyline that impacts a family of titles and one that impacts nearly every major character in the publishing line. These smaller crossover storylines, which I call "incidents" for lack of any better term, typically sell far lower than true event titles do.

An event title will normally sell well over the 100,000 mark but these titles which only involve a small set of characters are lucky to sell over 50,000 units. This chart includes both initial orders and any reorders to later appear on the top comics list in later months.

In addition to the sales of the core titles for these events and incidents, titles involved in the storyline usually see some sort of sales bump on the tie in issues. In March, none of the Avengers or X-Men titles tied into "Avengers vs X-Men" with the exception of "Avengers" #24.1 which sold approximately 52,169 units. Even though the story in that issue took place before "Avengers vs X-Men" #0, "Avengers" #24.1 was released a week after it. With both "Avengers" and "Uncanny X-Men" selling well under 60,000 units, we could see a huge bump in sales in April on those titles and the other titles involved in the crossover event. Both franchises seem like they could use the bump in sales. Regardless, given the number of relaunches Marvel has done in recent years, it would not be the least bit surprising for both franchises undergo yet another shuffling of titles at the end of the event. That would provide yet another round of new first issues resulting in the usual short term bump in sales. While this marketing technique works in the short term, over use of it makes it less effective each time they do it.

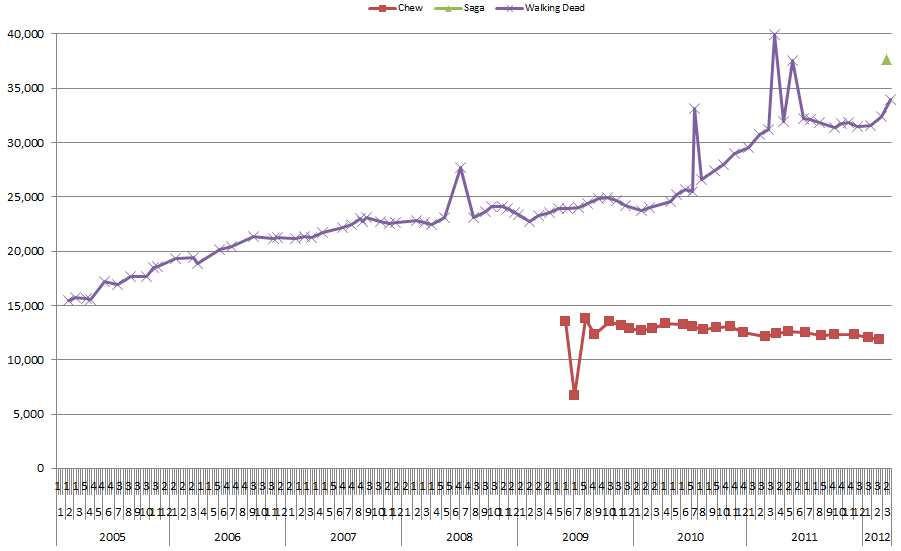

Over at Image, "Saga" #1 launched very strong with around 37,645 units making it both the top selling Image title and the top selling title not by Marvel or DC in March. As strong as those sales are, two things may have kept that title from even greatly success.

First, it was a mature reader title preventing younger readers from being able to buy it. The number of younger comic book readers that exist and might want to reader a science fiction/fantasy title like "Saga" is debatable. Regardless, it seems like a questionable business move to limit the potential readership of a property unless absolutely necessary artistically. A title like "The Boys," for instance, would be fundamentally different without the aspects that mandate the mature readers label for the title. The same might end up applying to "Saga" but with only the first issue to judge by, the mature content in it seems like it might not be required. In either case, it is great that the creators have the complete freedom to make whatever artistic and business decisions they want to with their property.

The other thing that limited the sales of "Saga" #1 was availability. It sold out through Diamond with the second printing not being available until April 11th when "Saga" #2 ships. The orders for that second printing were double the print run resulting in a third printing which will be available on April 25th. This is an indication the marketing of "Saga" might have been handled better to help retailers more accurately gage the demand and have an adequate supply on hand to sell. Limited supply is a better problem to have than limited demand but both limit the number of sales. One of the smartest ways DC supported the New 52 was to keep the early issues constantly available. There is the possibility the buzz on "Saga" will quickly get replaced by the buzz on "Avengers vs X-Men" or whatever big thing is going to be in the May Previews and by the time that third printing of "Saga" #1 is on store shelves the supply will exceed the demand. Hopefully that won't be the case and we'll see both this strong reorder activity for the first issue reflected in the April sales data as well as higher sales for the second issue.

"The Walking Dead" #95 sold an estimated 33,919 units. Since "Saga" is an ongoing monthly title, it displaces "The Walking Dead" as the top selling ongoing title from Image Comics. Hopefully, Robert Kirkman will see this as a challenge and work that much harder on making "The Walking Dead" the best comic book series it can be. Despite "Saga" outselling "The Walking Dead" by around 3,725 units, Kirkman has the potential advantage of sales momentum. "The Walking Dead" has been on a slow but steady upwards sales trend since it started. Other Image titles like "Chew" have launched with a similar kind of warm reception from the comic book reader audience only to quickly level out in sales after the initial order adjusting by the retailers. That having been said, "Chew" still qualifies as a major success given the reasonably stable, if slightly decreasing, sales over the past few years. At this point, the challenge for Brian K. Vaughan and Fiona Staples is to keep up the quality and story momentum of "Saga." Hopefully it will be another long term success with a similar upwards sales trend like "The Walking Dead".

Over on the top trades list, the sales at the top of the list continue to be modest with "The Walking Dead" v1 trade paperback topping the list with 5,881 units. Over at DC, all of the various Flashpoint trades except for the main "Flashpoint" trade paperback itself were outsold by "DMZ" v11 trade paperback. Overall, March was something of a lackluster month for trade sales from Diamond to retailers.

Perhaps the most revealing information is hidden in the top trades list. Not only is there an unusually high number of Marvel trades with reorder activity but the Retail Rank of those items indicate many of them were sold at a steep discount. As far as the Diamond market share statistics are concerned, units are units and dollars are dollars regardless of it the publisher made a profit on the items or sold them at fire sale discounts. Here were a few Marvel trades in February such as the "Wolverine: Death of Wolverine" trade paperback, the "Infinity Crusade" trade paperback and the two volumes of the "X-Men vs Apocalypse" trades which appear to have been offered as excessive discounts.

A good example on the March top trades list is at ranks 286 and 287. At rank 287 is the "Batman: Dark Victory" trade paperback with a cover price of $1.99 and an order index value of 0.32. The retail rank for "Batman: Dark Victory" was 209 meaning that 208 items were involved for a high dollar total than it was. The order index value is the relative sales strength compared to a benchmark item. In March, the benchmark item was "Batman" #7 with an order index value of 100.00 which equated to roughly 127,414 units. The order index value of 0.32 equates to around 408 units in March 2012 give or take about 6 units. The scale changes from month to month so an item with an order index value of 0.32 is some other month could have sold significantly more or less units depending on the sales of the benchmark item for that month.

Regardless of the actual number of units, two items with the same order index and the same cover price should have the retail rank with any difference being due to a difference in discounting. The item at rank 286, "Wolverine Origins: Dark Reign" trade paperback which had the same order index value of 0.32 and the same cover price of $19.99 yet had a retail rank of 831. Clearly the "Wolverine Origins: Dark Reign" trade paperback was offered at a better discount to retailers than the "Batman: Dark Victory" trade paperback was. As for how different the discounts were is next to impossible to tell with the available data. As similar oddity can be seen with the "Fear Itself" #7.2 reorder activity on the top comics list at rank 298 which had a retail rank of 1418. These retail ranking anomalies raises the possibility that the overall market share for Marvel has been boosted in recent months by massive discounting of selected items.