Mayo Report for 2020-01

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

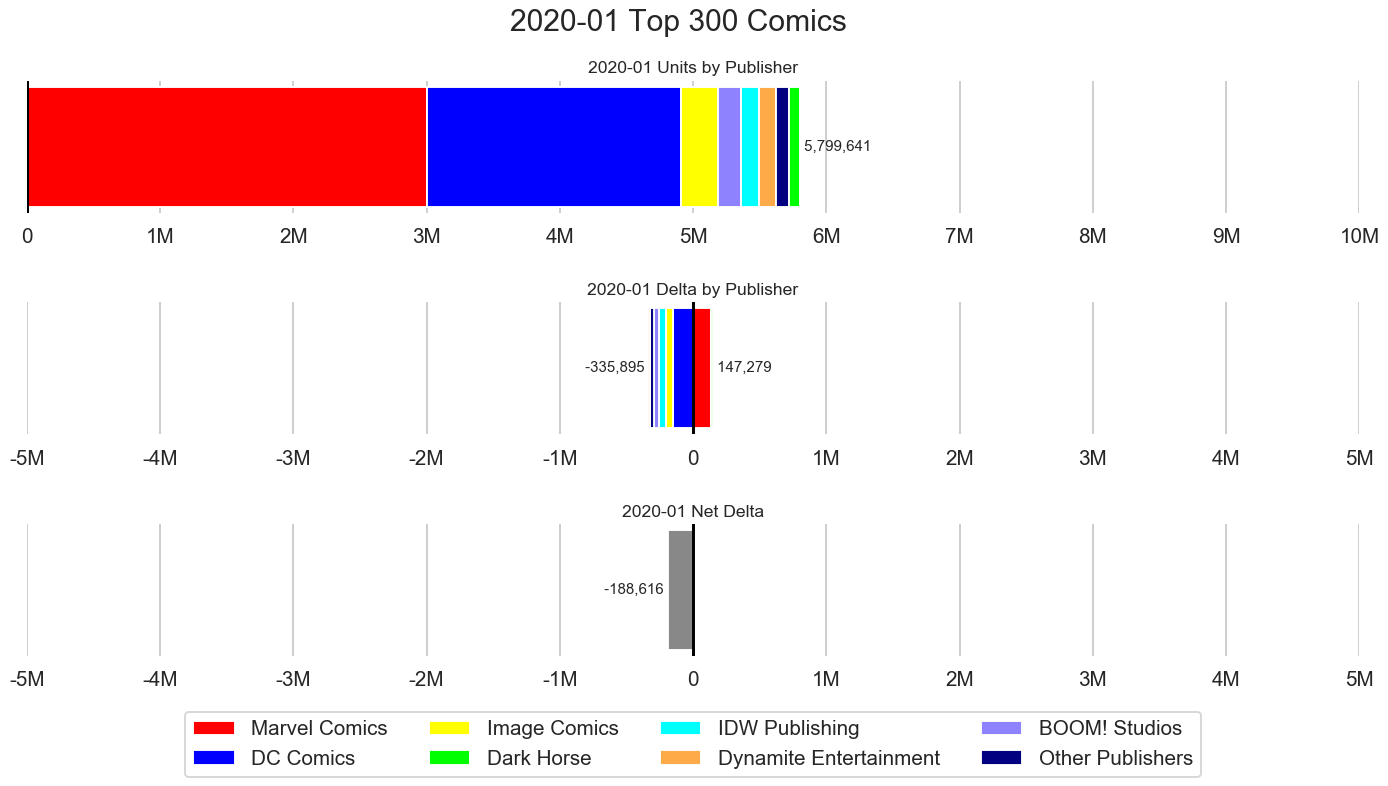

January 2020 had 5,799,641 units in the top 300 comics list, a decrease of 188,616 units from last month. Only five items sold over 80,000 units with the next best selling item selling until 67,000 units. Sales slumps at the start of the year are common.

Marvel Comics placed 3,006,653 units in the top 300 comics, an increase of 134,115 units and accounted for 51.84% of the total units.

DC Comics placed 1,905,252 units in the top 300 comics, a decrease of 153,837 units and accounted for 32.85% of the total units.

Image Comics placed 275,984 units in the top 300 comics, a decrease of 52,370 units and accounted for 4.76% of the total units.

The premiere publishers accounted for 98.26% of the total units for the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 1.74% of the total units for the top 300 comics.

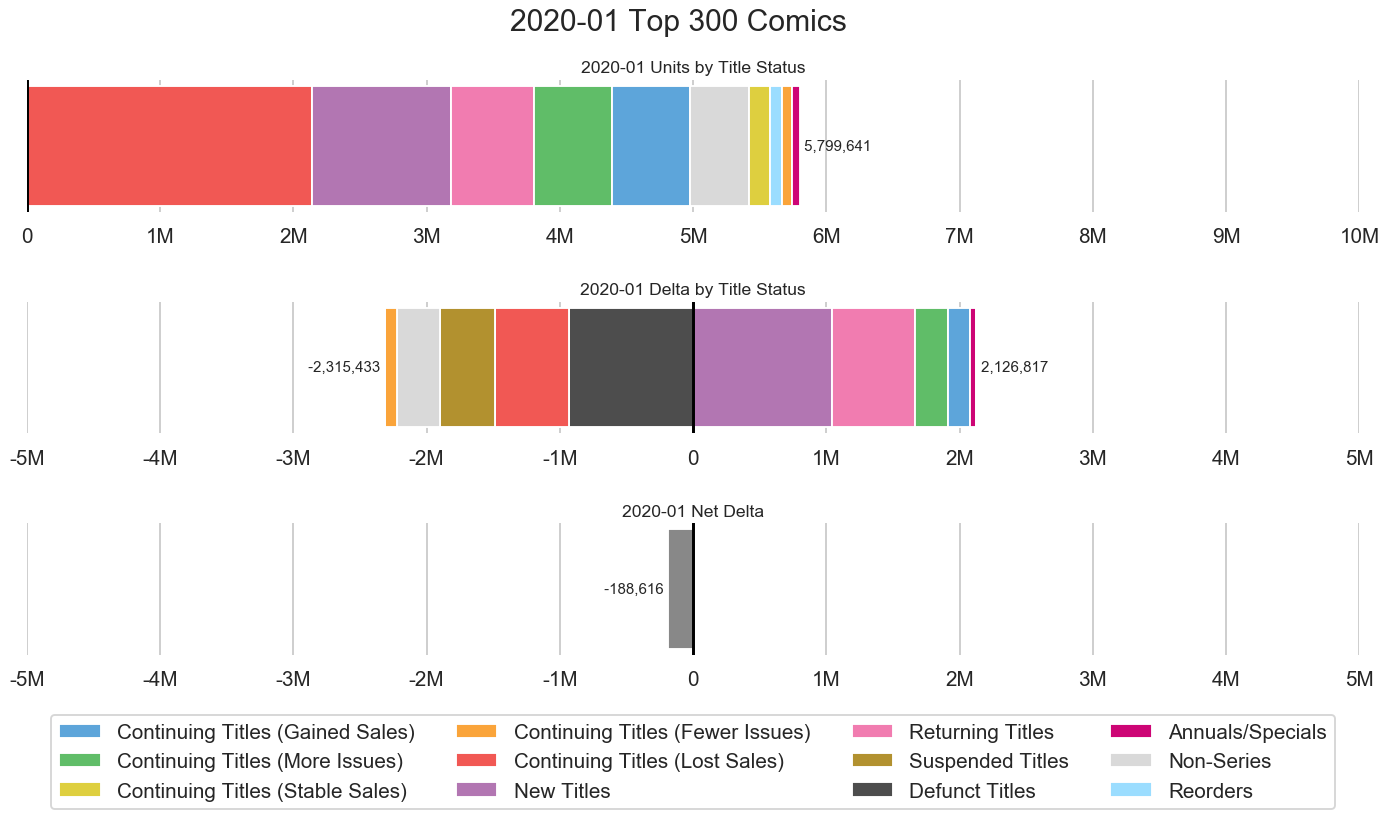

The up-swing of 2,126,817 units from new and increased sales was not enough to compensate for the down-swing of 2,315,433 units from lost sales for the net decrease of 188,616 units.

The volatility of the sales is worth noting with a swing of over two million units in each direction. Gone are the days when nearly every title release a single each and every month. Some of the volatility is caused by the constant rotation of titles. The constant replacement of poor selling titles with new titles is causing a significant amount of the volatility.

Over 20% of the top 300 was first issues. The majority of which were either one-shots of the first issue of a limited series. A limited series being defined in this case as a series with a known run of six issues or less. The term "limited series" has become increasingly meaningless given the short run of so many titles these days. The majority of the first issues are from Marvel. A few of the first issues are titles which are likely to still be around this time next year like Thor, Star Wars and probably Guardians of the Galaxy. If Guardians of the Galaxy is around this time next year, odds are good that while it might still be the same volume as now, it is as likely to be a new volume of the title, probably with a new line of of characters and creators.

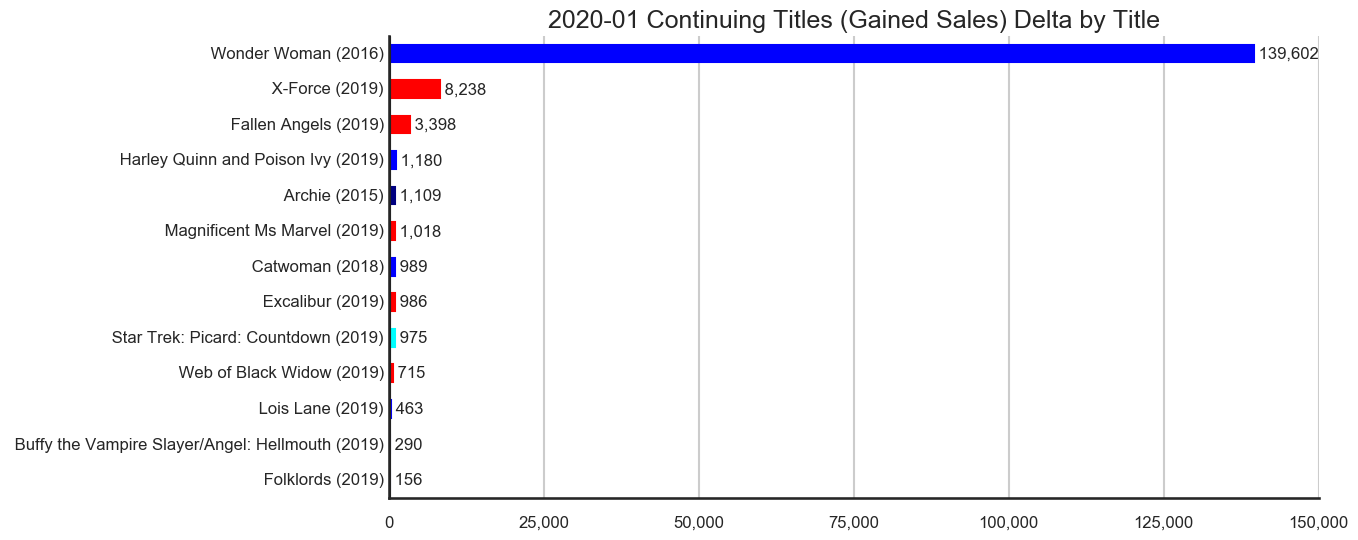

The 13 titles across the 5 publishers in the continuing titles which gained sales category accounted for 584,629 units in the top 300 comics with an upswing of 159,119 units.

Wonder Woman accounted for 87.73% of the change in this category. Wonder Woman #750 topped the list with 167,377 units. Milestone issue numbers like that tend to do well partially because of the issue number and partially because of the increased size and additional story content. Sales will most likely be back down below 30,000 units with the next issue. Depending how things go with DC, this issue might end up being a key issue in the future as it seems like it might have been the soft launch of the rumored 5G initiative at DC.

Everything else in this category seems insignificant in comparison.

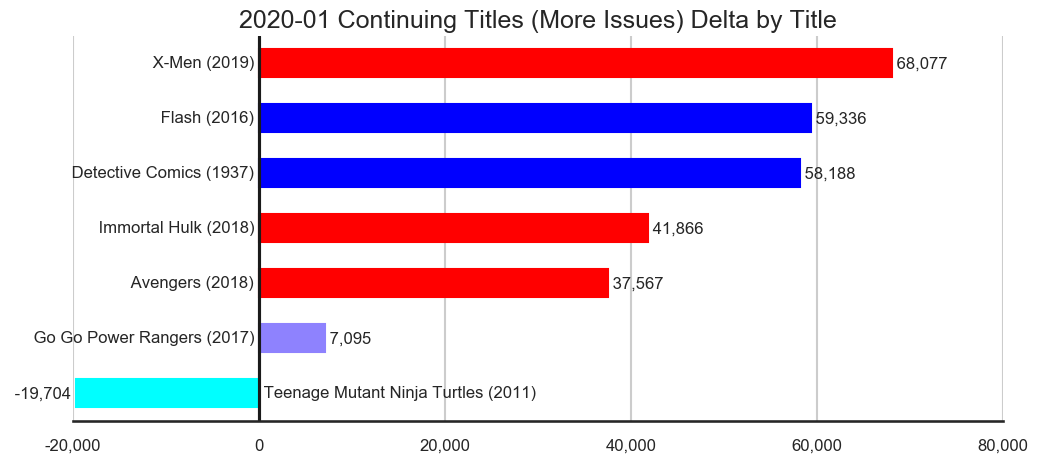

The 7 titles across the 4 publishers in the continuing titles which shipped more issues category accounted for 587,930 units in the top 300 comics with an upswing of 272,129 units, a downswing of 19,704 units for a net an increase of 252,425 units.

X-Men accounted for 26.97% of the change in this category. It is still a little too early to know for sure but it looks like X-Men has displaced Batman as the strongest ongoing title.

Flash released three issues in January, two of which were released at two different price points. The Flash is often a key character when a "new age of DC" kicks off. It will be interesting to see if that holds true with 5G or not. Either way, the title is selling around 30,000 units these days. The sales aren't low enough to mandate a retooling of the title but there is room for improvement.

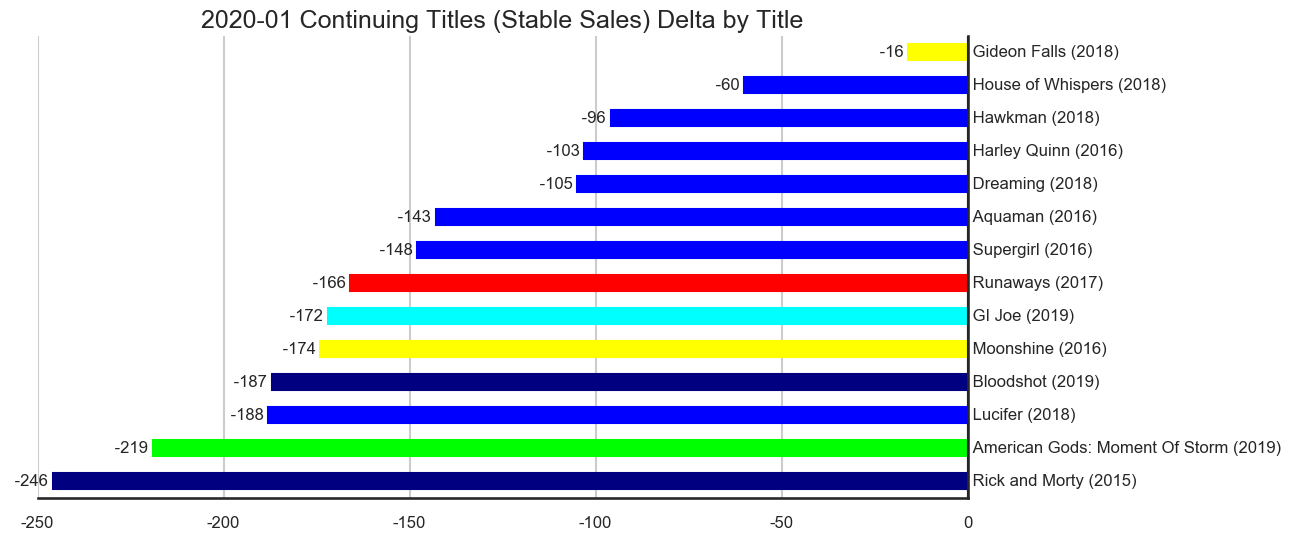

The 14 titles across the 7 publishers in the continuing titles with reasonably stable sales category accounted for 154,287 units in the top 300 comics with a downswing of 2,023 units.

DC Comics accounted for 41.67% of the change in this category. A number of DC titles continue to show a slow decline in sales such as Hawkman, Harley Quinn, Aquaman and Supergirl. All of these characters are ones which can often but not always sustain a title. Word is Supergirl will be ending in a few issues. Supergirl #38 sold 11,945 units which is low enough to justify ending the title. Aquaman and Hawkman are selling just enough better to keep them around a little longer. The sales on those titles are low enough that if they continue to decline, those titles might end as well.

DC has a lot of characters which are in this group which can almost sustain a title but struggle to do so. Mainly of them were members of the Justice League back in the Satellite era back around the 1970s and 1980s. Why not build a team title around them? The core group could be picked from Supergirl, Hawkman, Aquaman, Firestorm, Martian Manhunter, Atom, Elongated Man, Green Arrow, Black Canary with other characters like Vibe, Gypsy, Steel, Red Tornado and Vixen cycling in and out.

If you have a number of characters which are popular enough to try to do solo titles for but not quite popular enough to sustain those titles, doesn't it make sense to group them together into a team title which is more likely to sell strong enough to stay afloat. Part of the trick to making that work is for each of the characters to get enough focus that the readers picking the team title up for just one or two of them are happy enough to keep reading.

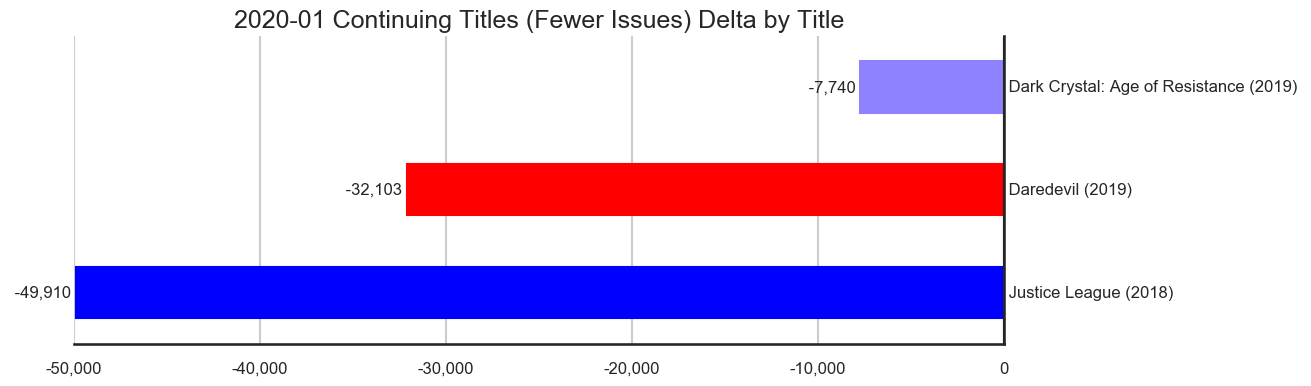

The 3 titles across the 3 publishers in the continuing titles which shipped fewer issues category accounted for a downswing of 89,753 units.

Even with four shipping weeks in December, one of which was a rather small shipping week, and five in January, a few titles only shipped a single issue in January versus the two in December. As a result, the overall sales for those titles dipped in January.

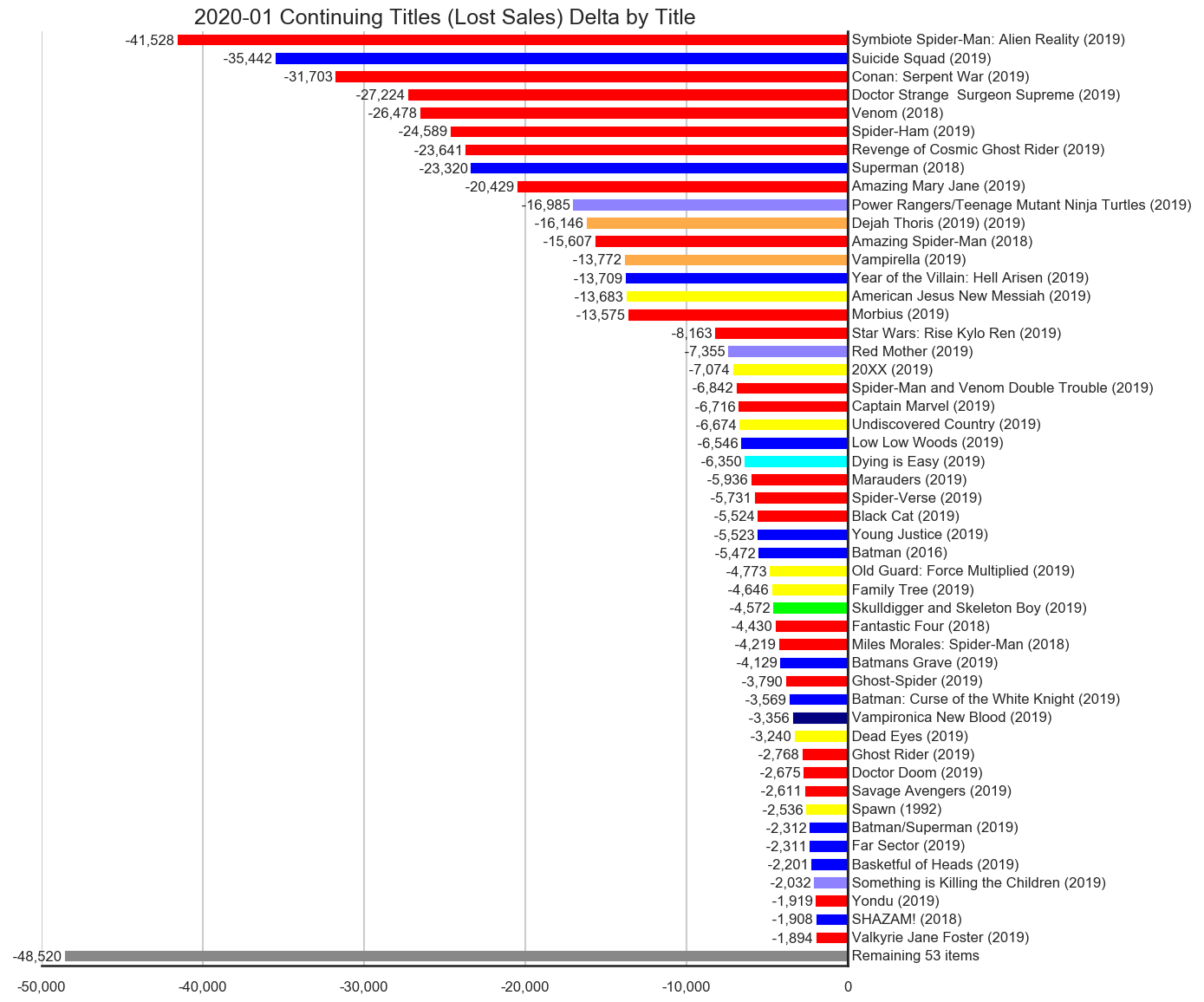

The 103 titles across the 11 publishers in the continuing titles which lost sales category accounted for 2,139,886 units in the top 300 comics with a downswing of 556,148 units.

Marvel Comics accounted for 53.13% of the change in this category. A number of the titles in this category were second issue drops such as Symbiote Spider-Man: Alien Reality, Suicide Squad, Doctor Strange, Surgeon Supreme, Spider-Ham and Revenge of Cosmic Ghost Rider.

Superman #19 was down 25,679 units from the previous issue and ?2,768? units below Superman #17. The reveal in the previous issue boosted sales to retailers for the issue but is unlikely to have gained any meaningful number of new readers.

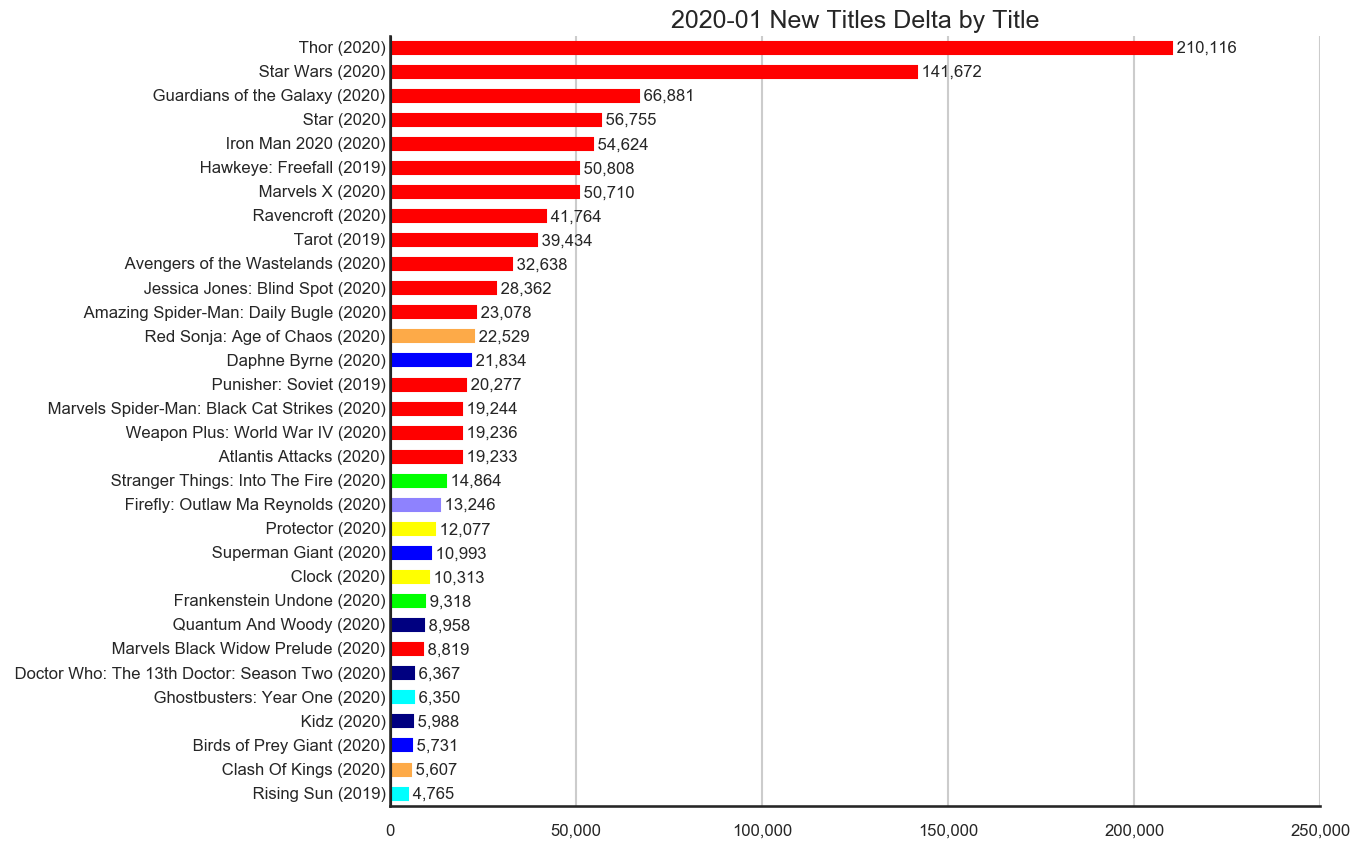

The 32 titles across the 10 publishers in the new titles category accounted for an upswing of 1,042,591 units. Marvel Comics accounted for 81.97% of the change in this category.

Thor #1 and Star Wars #1 both sold well but there is the question of if they might have sold better if they had been fully included in the Previews process instead of just being in the catalog but not in the order form. These items and a few others were technically solicited between Previews meaning that some people might have missed ordering them. Given the high profile nature of those two titles, they probably didn't suffer much in the way of potential missed sales. Titles like Tarot, however, probably would have sold noticeably better.

Iron Man 2020 kicks off that story arc which will span a number of miniseries. This is a banner storyline, not an event since it only impacts the Iron Man family of titles. Which is to say it replaces the main Iron Man title and spins out a number of related titles to temporarily create a family of Iron Man titles. This approach has been successful for Marvel so they will likely continue it until it no longer works.

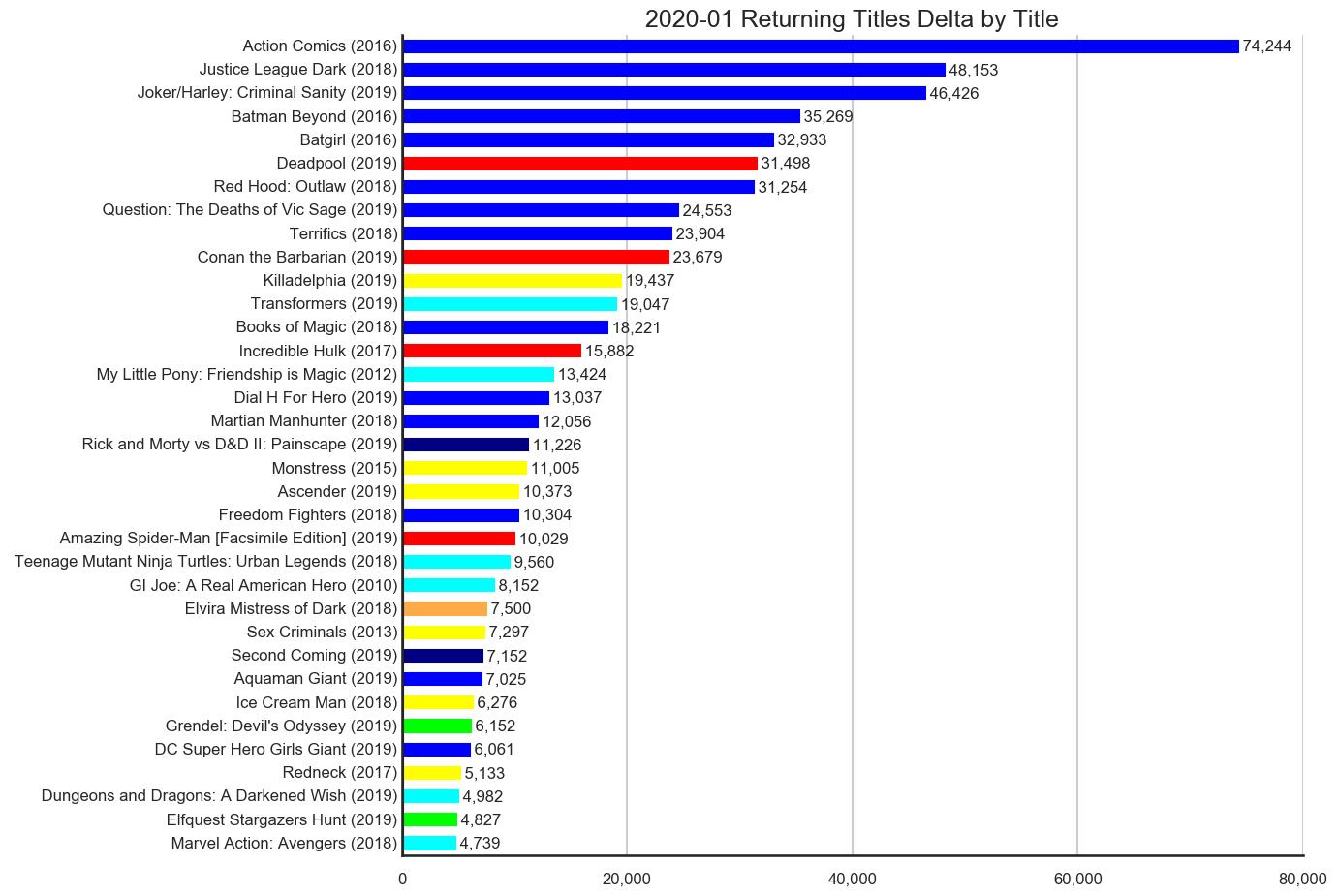

The 35 titles across the 8 publishers in the returning titles category accounted for an upswing of 620,810 units.

DC Comics accounted for 61.76% of the change in this category. The small final week in December resulted in a few DC titles skipping that month with those issues falling into January. This isn't uncommon when Christmas and New Year's Day impact new comics day.

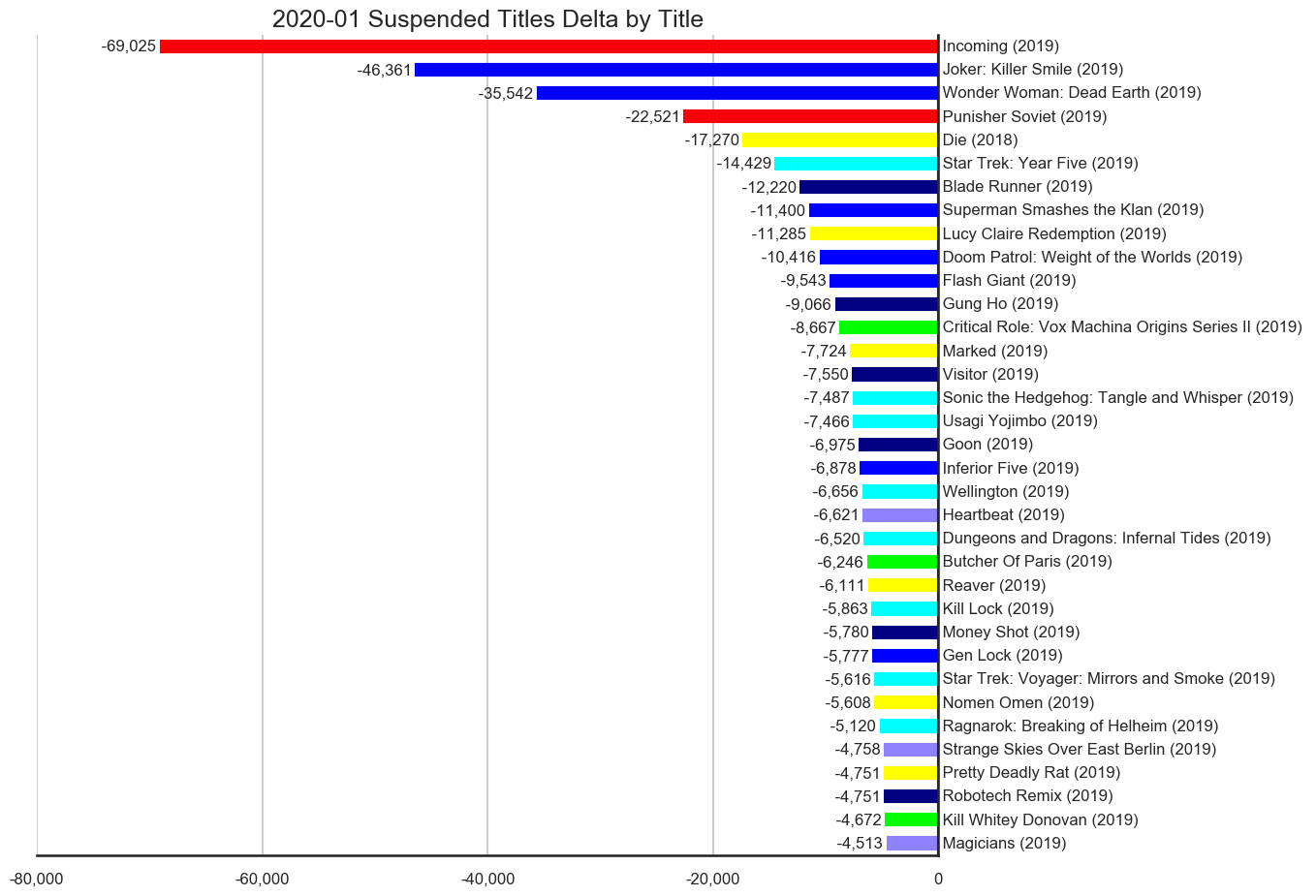

The 35 titles across the 11 publishers in the suspended titles category accounted for a downswing of 411,188 units.

Incoming was a one-shot but is showing up here because not all of the incentive covers were listed on the weekly shipping lists. This happens from time to time.

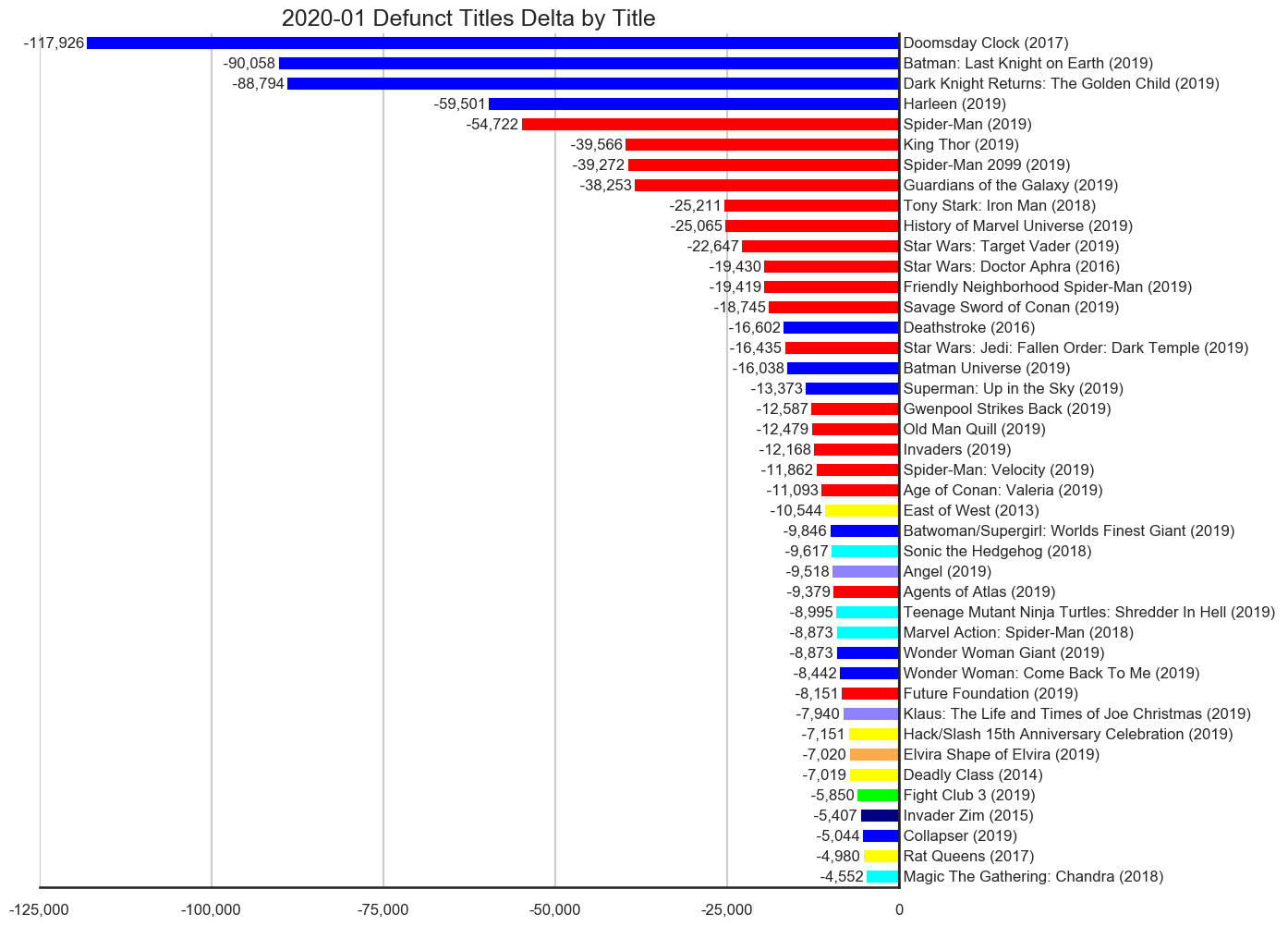

The 42 titles across the 8 publishers in the defunct titles category accounted for a downswing of 928,447 units.

DC Comics accounted for 46.80% of the change in this category with the end of Doomsday Clock, Batman: Last Knight on Earth, Dark Knight Returns: The Golden Child and Harleen last month.

Marvel had a number of titles end last month like King Thor and Tony Stark: Iron Man. But, as is common with Marvel, those title titles were immediately replaced with Thor and Iron Man 2020. Many of the other titles which ended were limited series. One or two titles which were one which were unlikely to last more than a year or so given the track record in recent years of the properties such as Invaders.

Some properties simply aren't popular enough for whatever reason to sustain an ongoing title no matter how much a publisher or creative team might want them to. Trying to get around that by swapping out a miniseries like Agents of Atlas into Atlantis Attacks might work but it might also backfire. Some readers might miss in the solicits that the story from the first miniseries won't conclude but will continue in a modified form in the second miniseries. Other readers might have skipped the fist miniseries and be confused by a first issue which continues a story already in progress.

Agents of Atlas #5 sold 9,379 units last month and Atlantis Attacks #1 which continued the storyline sold 19,233 which is far more than an Agents of Atlas #6 with the same contents would have sold. The results speak for themselves. Marvel clearly got better sales on the issue by ending one miniseries and starting another. The question is around the long term impact of publishing a number of miniseries which don't conclude the stories at the end.

A series of miniseries sells different than an ongoing series. But reader have different expectations around story pacing from a miniseries and an ongoing series. Miniseries which pick up stories already in progress and with with no resolution is not a good long term publishing strategy even if it works out great in the short term. Eventually readers will get wise to the tactic and stop getting those miniseries.

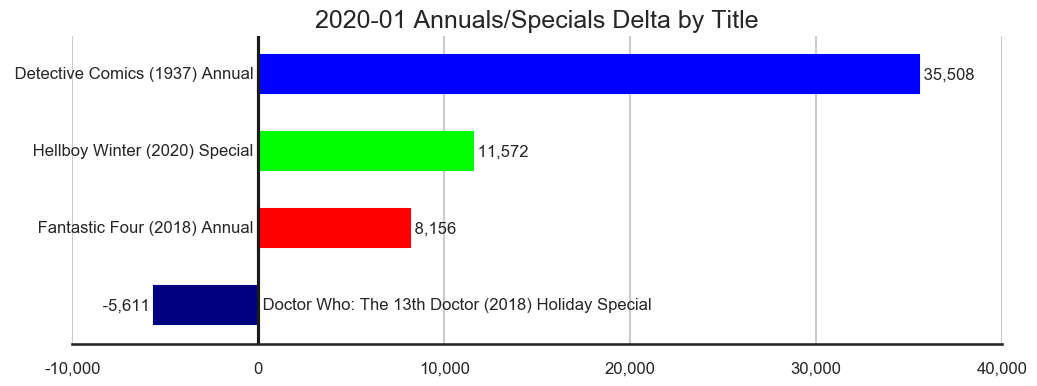

The 4 titles across the 4 publishers in the annuals/specials category accounted for 55,236 units in the top 300 comics with an upswing of 55,236 units, a downswing of 5,611 units for a net an increase of 49,625 units.

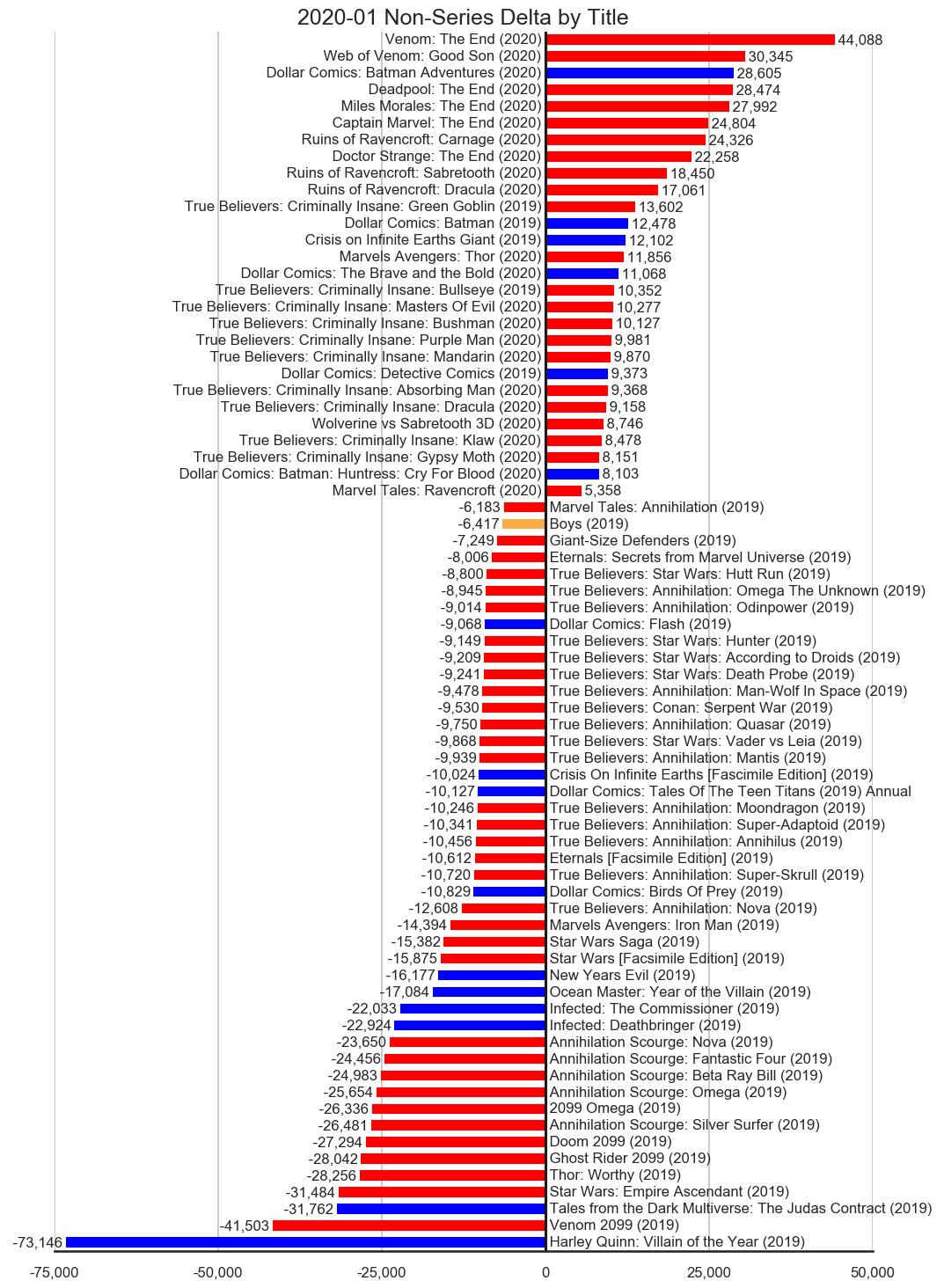

The 73 titles across the 3 publishers in the non-series category accounted for 444,851 units in the top 300 comics with an upswing of 444,851 units, a downswing of 772,725 units for a net a decrease of 327,874 units.

Marvel dominate this category. The ongoing strength of the True Believers line continues with a solid set of rotating themes. Last month is was Star Wars and Annihilation and this month it was Crimianlly Insane. Marvel continues to rotate a number of other stories arcs and themes through this category like Annihilation Scourage, Ruins of Ravenscroft and the various The End titles.

DC is getting into the game with the Dollar Comics line and things like The Infected. Hopefully DC will grow the reprint line into something as strong as Marvel's True Believers line. In addition to these reprints being a decent source of income, these reprints introduce newer readers to older material at really low price points. Building up a larger audience for older material can create the foundation needed to launch new titles for characters which might not otherwise be able to sustain a series.

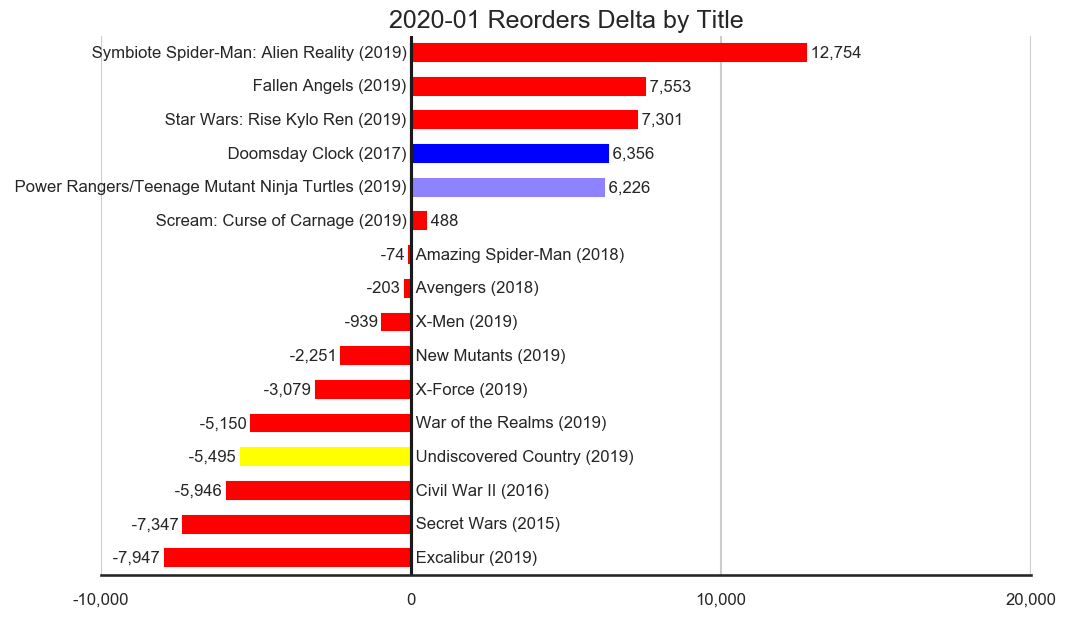

The 16 titles across the 4 publishers in the reorders category accounted for 88,666 units in the top 300 comics with an upswing of 40,678 units, a downswing of 38,431 units for a net an increase of 2,247 units.

Symbiote Spider-Man: Alien Reality had strong reorders for the first issue this month and reorders on the Dawn of X titles remains strong with reorders on most of the issues of most of the titles. Fallen Angels had a net increase in reorders while the others were down only because Fallen Angels launched last month and this with the first month reorders were possible. The strength of the House of X/_Powers of X_ relaunch of the X-Men franchise is impressive.

While 2020 is starting off a bit slow, which isn't unusual, things will almost certainly pick up in the coming months. Over at Marvel, the Empyre event will likely increase sales for Marvel. On the other hand, it will be interesting to see how the 5G arc plays out in the various Generation one-shots. It could be what DC needs to re-energize the readers or it could be one more thing which further confuses the DC Universe continuity. Either way, how it does will likely influence how DC does for much of the year.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.